What is Venmo?

Venmo is an app for exchanging money between friends, family, and other personal contacts. Venmo works as a digital wallet for fast peer-to-peer payments and money transfers. Venmo’s popularity has grown quickly, and it’s a preferred payment method for many students and small businesses.

Venmo is owned by PayPal — another popular payment service app for money transfers. The difference is that Paypal is more associated with business transactions, whereas Venmo’s payment service is designed to be used between friends and family.

Here are situations that Venmo makes easier:

-

Splitting bills in restaurants

-

Paying for taxis

-

Paying for group activities

-

Online shopping payments

-

Dividing rent among roommates

As with many other successful apps, Venmo is centered on convenience (and it's available for both Android and iOS devices). Though intended for friends and family, Venmo’s ease-of-use has made it popular for transfers between strangers too — mostly for buying/selling goods. Venmo’s increasing popularity and its wider use has led to a surge of Venmo-related scams.

Is Venmo secure?

Generally, Venmo is safe, because it has several security measures to protect money transfers. But it was designed to be used with people you know and trust. When used outside of this intended purpose — like for exchanges with strangers — the security risks increase due to inherent flaws in the system. Venmo fraud and other scams often exploit these weaknesses.

Here are Venmo’s main security measures:

-

PIN numbers: Venmo requires a PIN number every time you log into the app. PINs may also be required when sending payments to other Venmo accounts. If your phone has biometric settings, you can set up Touch ID, Face ID, or fingerprint access — just be aware of some security risks of biometric locks.

-

Two-factor authentication: Venmo uses two-factor authentication to stop scammers from hacking your account. If the app doesn’t recognize the device you’re accessing your account with, it will send you a code to verify the login.

Two-factor authentication (2FA) uses a combination of password, biometric data, and notification to add extra security to your accounts.

Two-factor authentication (2FA) uses a combination of password, biometric data, and notification to add extra security to your accounts.

Venmo is a safe way to receive money from people you know, but you need to be careful when making transactions with strangers. Venmo doesn’t have a chargeback system to reverse payments in the event of a disputed exchange, and the app doesn’t offer buyer protection to cover scams. These issues can be settled only through your credit card provider, and Venmo refund scams take full advantage of this.

Venmo scams on Craigslist are also frequent. If you’re a seller, scammers can lie about making Venmo payments, then disappear after they get your goods. Also, stolen cards can be used to make Venmo payments — they ultimately get charged back by the card company after the exchange.

Is it safe to verify my identity on Venmo?

It’s safe to use Venmo to verify your identity, but be aware that scammers want to intercept your personal information. Venmo itself is regarded as a secure platform — but savvy hackers have been known to pose as the company reps to trick victims into giving up sensitive information.

Unwittingly giving up personally identifiable information to scammers is a major Venmo risk. This data can be sold or used for further exploitation.

Also, Venmo may ask you to verify your SSN (social security number) to confirm your digital identity. This information is highly valuable and scammers may try to trick you to get it. Know the scenarios when Venmo needs this information, so you can weed out the scams.

Here’s when Venmo will ask for your SSN:

-

If you send $300 or more in a 7-day period

-

If you transfer $1,000 or more to your bank in a 7-day period

-

If you create a group account

-

If you process more than 200 transactions in a calendar year using a business profile

Venmo will ask you to verify your identity in the app itself, via Settings > Identity Verification. Never send your social security number via email. If you’re unsure whether Venmo Support is emailing you, contact them directly to have your identity verified.

How do Venmo scams work?

Venmo scammers rely on situations where victims let their guard down. They use social engineering techniques to trick victims into giving up personal information. Or, they take advantage of Venmo’s security weaknesses — like its lack of a chargeback feature.

Venmo scammers often pose as company representatives and ask for personal information, similar to how tech support scams work. Venmo scams can occur via text, email, phone, or even direct communication. Because Venmo is a trusted company, unsuspecting victims may give up bank account details or even social security numbers.

Venmo scammers may pose as company representatives to try to trick people into giving up personal information.

Venmo scammers may pose as company representatives to try to trick people into giving up personal information.

Fraudsters often rely on apparently urgent communications that prompt victims to act without thinking. Whether you receive a Venmo security-check email or some other urgent notification, always verify that it’s sent directly from Venmo — especially if it requests personal information.

Venmo scams often take place when buying/selling with strangers. Since the app isn’t designed to be used with strangers, scammers exploit the lack of payment and buyer protections on Venmo.

Venmo scams resulting in identity theft are always a risk — and the consequences can be devastating. Learn how to prevent identity theft, and if you or someone you know falls victim, report identity theft immediately to prevent more damage.

Identifying a Venmo scam

Some Venmo scams are obvious, while others are subtle and quite convincing. But there are always telltale signs that reveal the scam. Identifying a Venmo scam requires knowing what to look for and attention to detail. Especially during money transfers or when you’re requested to reveal personal information.

Here’s what to look for when identifying a potential Venmo scam:

-

Suspicious domains: Legitimate companies, including Venmo, use clear and accessible domains to represent their business. If a URL or website seems fishy, it probably is.

-

Typos in the URL: This is a clear sign of a scam. Scammers will try to trick you into thinking you are dealing with trusted brands by slightly altering their web addresses.

-

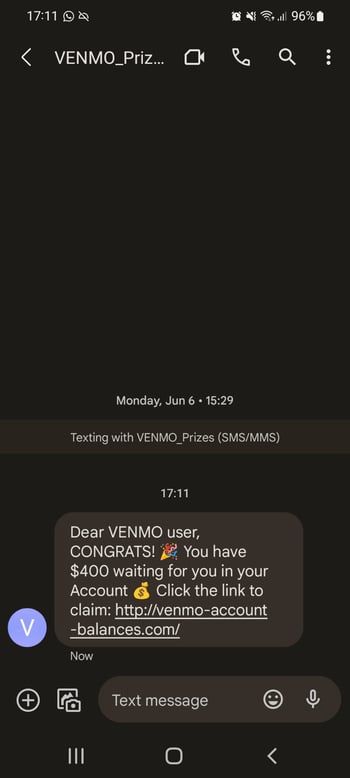

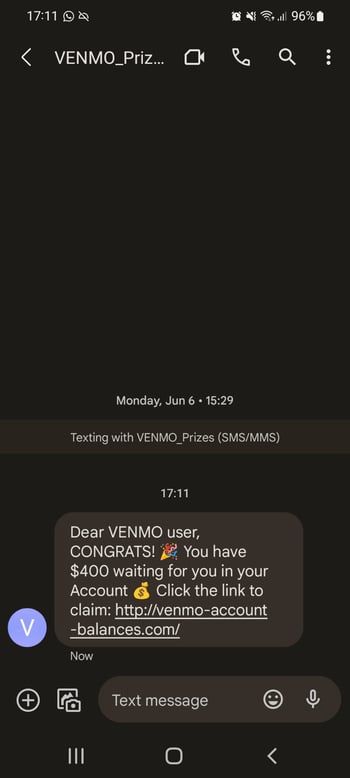

Unsolicited DMs, email, texts: Random communication from Venmo is a red flag, especially if they are requesting personal information. Ignore or report fake Venmo texts, potential Venmo scam calls, and other suspicious communication.

-

Job or rental lease offers: In these scams, “employers” or “landlords” ask you to pay upfront, or use your Venmo or bank account to move someone else's money. If you give away any money in these exchanges, don’t expect to see any return.

-

Random prizes or rewards: In order to claim your prize, a Venmo rewards scam will ask for your Venmo login details or other personal information. Never give away or enter your login details outside of the Venmo website or app.

-

Buyer scams: Buyer scams involve someone claiming to send a payment to your Venmo account after you ship an item and upload the shipping information. Venmo does not have this feature, and most likely you won't see any money once you ship the item.

-

Fake accounts: Scammers can create fake Venmo accounts of actual people to trick victims into transferring funds. In general, be suspicious of Venmo requests from strangers.

The most common Venmo scams

Many Venmo scams use social engineering tricks to carry out personalized scams. Common Venmo scams involve sob stories to emotionally manipulate you. Some scams use financial incentives and bribes — promising big rewards if you send money up front.

Here are some common Venmo scams out there today:

Using stolen credit cards

Stolen credit cards are at the center of many Venmo payment scams. Scammers use stolen cards to transfer money into victims’ accounts. The card company then initiates a chargeback, reversing the transaction after you’ve already sent the item. Because of these situations, Venmo recommends using the app only with close contacts.

Sending money by accident

In this trick, scammers transfer money into your account using a stolen credit card, then claim it was a mistake. They request you send the money into their personal account, and when the credit card company does a chargeback for the initial transfer, you’re responsible for the stolen money — and the scammer is long gone.

To avoid a Venmo fraud charge, hold on to the money that was initially sent. If the money sent to your account was a genuine mistake, the sender can sort out the details with their card company.

Fake sales, bogus prizes, and fraudulent rewards

One common scam involves a scammer buying goods and paying via Venmo — or via a fake Venmo app. Once the item is received, the scammer requests to reverse the transaction — leaving you without goods or money.

Scammers might also send messages claiming you won “free money” on Venmo. They ask you to click a link and enter your Venmo login details. This link leads to a phishing website trying to steal your Venmo account and password. Another version of this Venmo message scam offers a gift card for completing a survey.

Venmo phishing texts or emails

Venmo scams can take the form of phishing emails or smishing (SMS phishing) texts. Scammers create texts or fraud emails with Venmo designs to appear authentic. They ask you to click a link or enter personal information, like your social security number, bank account details, or credit card information.

Venmo phishing links lead to fake, pharming websites imitating the Venmo login page — stealing your data and financial information when you try to sign in. A real text from Venmo will not have typos, ask for sensitive information, or use a pushy tone.

Impersonating friends and family

Scammers create fake accounts of contacts you’ve paid in the past, using stolen information and profile pictures. Then, they contact you and request payments — usually at random and with a sense of urgency. After receiving a strange Venmo request, look up the public transaction history, network information, and contact that person directly to verify it’s really them.

Scammers selling hard-to-find items

Scammers can use platforms like Facebook Marketplace to sell coveted items — like tickets to sold out shows or the newest gaming console. When it's time to buy, the fraudster requests Venmo payments. Once the money is sent, the seller disappears along with the prospect of getting the item. Unfortunately, Venmo does not offer any fraud or buyer protection for these transactions.

Investment scams

In Venmo investment scams, someone requests a small amount of money on Venmo, with the promise of a larger sum for you after you bring more investors into the fold, like a pyramid scheme. The promised sum never appears and you lose out on your initial investment.

Another version of this fraud involves gift card scams, where a scammer asks you to pay for something by purchasing a gift card and then asks you to hand over the card’s details.

Reporting a Venmo scam

There are several ways to report a Venmo scam. You can contact Venmo directly, but since the app was designed to be used among trusted contacts, the company won’t do much to catch a scammer. Outside of Venmo, local authorities and independent agencies like the FTC can help victims of online scams.

Here’s how to report a Venmo scammer:

-

Report the fraud on Venmo: Go to Venmo’s official site and report the incident to Venmo’s support team directly. Though your options are limited, you can still dispute scam Venmo charges.

-

Inform the authorities: If you lost money, report the internet scam to government agencies, like the Federal Trade Commission (FTC) and the Internet Crime Complaint Center (IC3). You should also contact your local authorities.

-

Check your bank and Venmo accounts: To prevent further damages, change your Venmo account password to something strong, and check your bank accounts for unauthorized transactions. Then, ask your credit card company to block or charge back any unauthorized transactions.

How to protect myself on Venmo

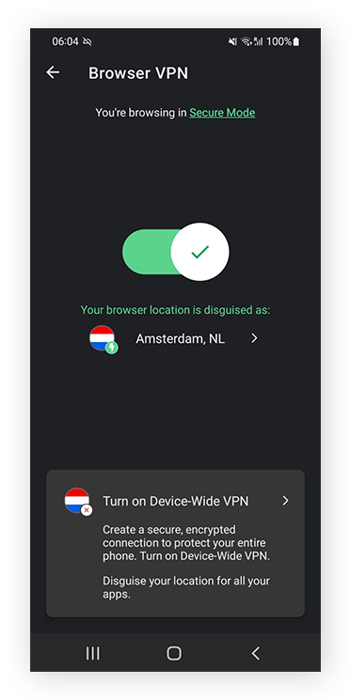

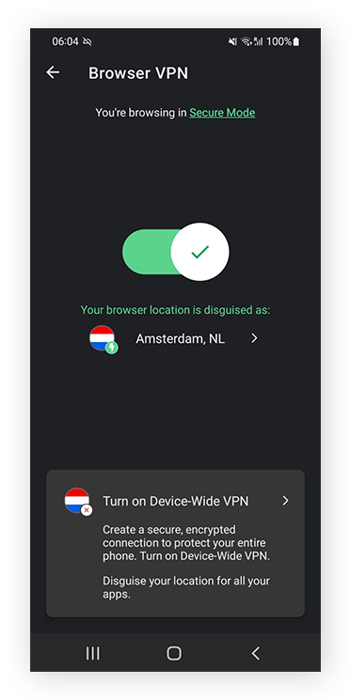

Prevention is the best protection on Venmo. Because the app doesn’t provide financial protection, understanding how scammers strike can help you avoid them. Use a VPN to encrypt any financial data you send online, and follow Venmo’s terms of service. Scams with Venmo are often due to unauthorized use, like transactions with strangers.

Here are some prevention tips to protect yourself on Venmo:

Don’t provide your details outside of Venmo

Cybercriminals have sophisticated means to trick you into giving up personal data. Don’t click unknown links in emails or text messages, and always verify the sender. If you’re unconvinced after a website safety check, the message is likely a scam.

Yes, it’s real when Venmo confirms your identity through your SSN — but be wary when giving this number out. Know the scenarios when it’s safe to verify your identity on Venmo. And if you have any concerns, contact Venmo directly.

Verify who you’re buying from or selling to

Though not recommended, it’s safe to Venmo a stranger as long as you take added precautions. If you must exchange money with strangers, it’s crucial to verify their Venmo accounts. Make sure they have a Venmo-approved business account, or label the payment as a “purchase” to a personal account.

Approved business accounts will say “Eligible items covered by Purchase Protection” under the “Pay” button.

Invest in robust security tools

Practicing good digital hygiene and using reliable cybersecurity tools will help you protect yourself against Venmo scams and other attacks.

Multi-factor authentication will protect your accounts from unauthorized logins, and a reputable VPN is another essential privacy tool. Among the many benefits of a VPN, it uses data encryption to protect your personal information from falling into the wrong hands.

Use a private browser to stop scammers from tracking you online

Though Venmo can be trusted, the potential for scams is high. Scammers can use your stolen information to track data across other websites or compromise your other accounts. With the right habits and strategies you can avoid Venmo scammers, but the online trackers that follow can be harder to shake.

AVG Secure Browser is a fast, secure, and private browser that masks your browser fingerprint and stops scammers from tracking your online activity. Use the integrated VPN and antivirus features to shore up your online security and block malicious downloads. Start browsing the web safely today with AVG Secure Browser.

Two-factor authentication (2FA) uses a combination of password, biometric data, and notification to add extra security to your accounts.

Two-factor authentication (2FA) uses a combination of password, biometric data, and notification to add extra security to your accounts. Venmo scammers may pose as company representatives to try to trick people into giving up personal information.

Venmo scammers may pose as company representatives to try to trick people into giving up personal information.